What’s Loan to Value Ratio? Loan to Value Ratio, also known as LVR, is the amount you are borrowing (as a percentage) of the value of the property. It is used by lenders as a measure when assessing the risk of a loan.

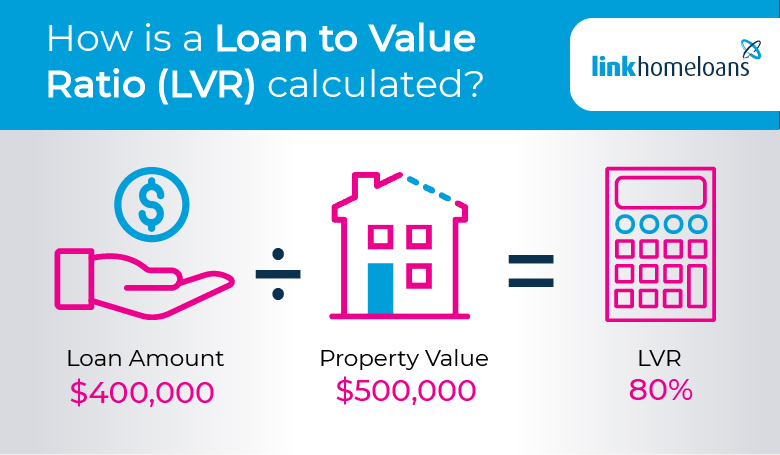

How to calculate LVR?

For example, if the value of the property is $500,000 and you have a deposit of $100,000, you’d need a loan amount of $400,000 (excluding fees). To calculate your LVR, divide the amount you need to borrow ($400,000) by the value of the property ($500,000) and multiply this by 100 to give you a percentage.

$400,000/$500,000 x 100 = 80%

Try our LVR calculator to quickly see how different deposit and purchase price options work out.

What are some of the benefits of a lower LVR?

Loan to Value Ratio plays a vital role in the assessment of a loan and can influence in how much you can borrow from a lender. Ultimately the higher your LVR is, the riskier your loan is to a lender, so the lower your borrowing power may be.

The larger your home deposit, the lower your LVR will be. This means that you’re contributing more equity towards the property, and the lenders’ exposure is reduced if you’re unable to meet your repayments. This means that you may be eligible for more favourable interest rates or loan terms. So, it’s important to keep in mind your LVR when figuring out how much you could borrow.

How your LVR influences your mortgage

An application with an LVR of 80% or more may be considered higher risk by a lender and as a result you may be required to pay Lenders Mortgage Insurance (LMI). LMI protects the lender if you default on your home loan. Even though you pay for it, LMI protects the lender – not you.

At Pepper Money, we don’t charge LMI on any of our home loans, but we do charge a risk fee based on your LVR. This is known as a Lender Protection Fee (LPF).

Unlike traditional lenders, we’re self-insured so LPFs allow us to manage our own risks when it comes to assessing your home loan application, without having to seek third-party LMI approval. This allows us to be more flexible as we’re not reliant on an insurer’s criteria.

Get in touch with a Lending Specialist

Tell us about your situation. The more we learn, the better we can help.

0800 466 784

Contact Us

Apply Now